Our upcoming Small Business Owner Accounting School is now full. Look for the next session sometime in March or April.

Our upcoming Small Business Owner Accounting School is now full. Look for the next session sometime in March or April.

|

Come join us the 3rd Wednesday of every month for our Business to Business Networking Luncheons. On top of having a chance to do some important networking, we also have a speaker that will discuss various topics like: Business Startup, Best Practices, Networking, Financing/Loans, Credit, Bookkeeping, Marketing/Social Media and much more. A light lunch with drink will be offered.

Speaker: Peter Busch, NBC2 New Anchor Topic: Business & The Media |

Peter Busch is a multiple EMMY award winning journalist who anchors NBC2 News at 5, 5:30, 6 and 11pm. He won three consecutive Emmys for news reporting during his time at KPHO in Phoenix. More recently, Peter won the prestigious Edward R. Murrow Award for a series of stories on Rio de Janeiro’s preparations for the 2016 Olympic Games. Peter has covered major national stories over his 15 years in television news, including Hurricane Katrina and the 2016 presidential election. He learned to speak fluent Spanish when he lived in Mexico City in 1999. Peter then went on to graduate with honors from the University of Arizona, where he was a member of the swim team. Peter now lives in Lee County with his wife Rachel, their three daughters, and their dog, Edison. |

Register Here for the B-2-B Meeting

The Rotary Club of Cape Coral Sunset invited us to speak during their Vocational Service Month on Empowerment Works programs and how they impact vocational training. We had a good time with great discussion and friends!

I wanted to look into some real life examples of how the new tax law will effect small business owners and others so I computed several different tax scenarios and compared the tax results under the old law with what they would have been under the new plan just passed into law.

Here is what I generally found.

If you are a small business owner, the 20% deduction for pass through income should reduce the amount of tax you pay significantly, particularly if your business makes you a higher income tax payer. This is should be an incentive for anyone who is thinking of starting their own small business.

If you are not a business owner and are not a high income tax payer; AND you currently do NOT itemize your deductions, you will probably pay a little less tax under the new plan.

If you are not a business owner and are not a high income tax payer; AND you currently DO itemize deductions, it is POSSIBLE that you may actually pay MORE tax under the new plan.

These calculations were just examples based on prior tax returns. I found a tax calculator online that will do a comparison of how the tax cuts will effect YOUR situation.

Click here to go to the tax law comparison calculator

Get out your 2016 tax return and use the following link to do your comparison. Use the “Create Your Own Scenario” link to customize it to your 2016 return or enter your estimates for 2017 and 2018.

I found it to give very close to the same results to my analysis above, but much easier than what I went through to compute it.

You should check with your tax advisor about your situation.

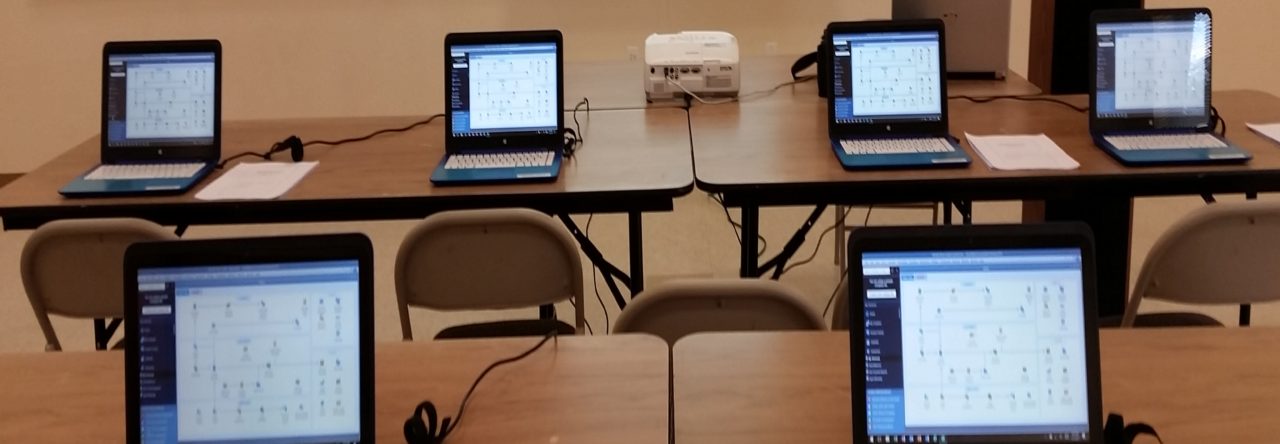

This is a four session class on Wednesday evenings from January 31, 2018 through February (no class on February 14th). This session will teach entrepreneurs who own their own business or individuals looking for a new career the basics of keeping track of a business’ finances. Sign up and pay soon to guarantee your seat!

Powered by WordPress & Theme by Anders Norén